Who Owns the Life Insurance Policy in an SMSF?

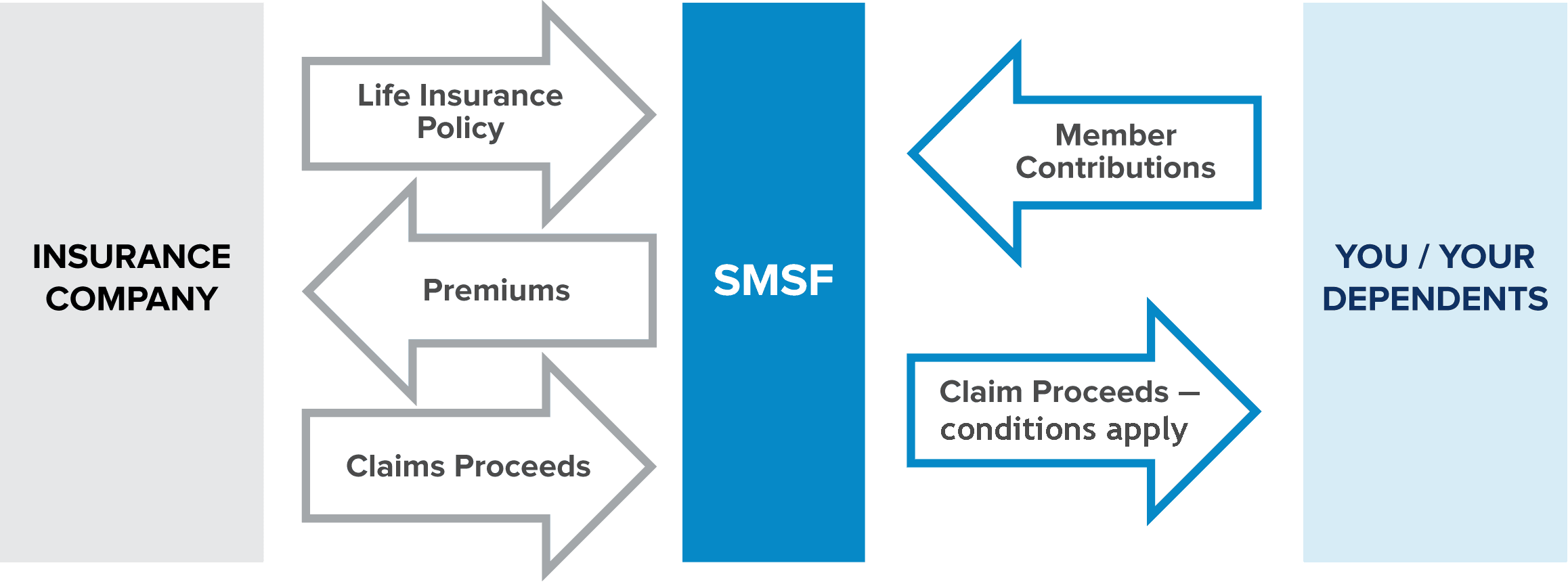

In Australia, when a life insurance policy is taken out through an SMSF, the legal owner of that policy is the SMSF itself, not the individual member. Even though the policy may cover the life of one of the members, the policy is held by the SMSF as part of the fund’s overall assets.

This distinction is crucial because it shapes how premiums are paid, how claim proceeds are handled, and how the policy fits within the regulatory framework of Australian superannuation laws. These rules, governed by the Superannuation Industry (Supervision) Act 1993, ensure that life insurance in an SMSF is managed under strict guidelines for the benefit of its members and their dependents.

What Happens When a Claim is Made?

If the insured member passes away or becomes disabled, the proceeds from the insurance policy are paid directly to the SMSF. The trustees of the SMSF are then responsible for distributing these funds in accordance with the law and the trust deed of the SMSF.

Typically, this means the insurance payout will be distributed to the member’s nominated beneficiaries or their estate, depending on the specific terms of the fund and any binding death benefit nominations in place. It’s important for SMSF trustees to understand that the proceeds are not directly paid to the individual or their beneficiaries by the insurer. The process must go through the SMSF first, ensuring it aligns with superannuation rules designed to safeguard retirement savings and death benefits.

Why Are the Rules Set This Way?

The purpose of an SMSF is to provide retirement benefits to its members and, if the worst happens, to protect their loved ones. Life insurance in an SMSF helps provide financial protection in the event of death or disability, but the insurance must always be aligned with the overarching goal of the fund: to provide for members’ retirement or their dependents in the event of a member’s death.

By making the SMSF the owner of the policy and the receiver of the proceeds, these rules help ensure that the funds are used in a way that complies with superannuation law. This helps prevent misuse of insurance benefits and ensures that any payouts are handled responsibly and fairly.

Who Pays the Premiums?

Since the SMSF owns the life insurance policy, the SMSF pays the premiums from its own assets. This is an important point because it means the cost of insurance is funded using the contributions made to the SMSF or the earnings the fund generates. The trustees of the SMSF need to be aware that these premiums can reduce the amount available for investment in other assets and, consequently, affect the overall retirement savings of the members.

For this reason, it’s essential for trustees to regularly review the fund’s insurance arrangements. Are the members’ insurance needs being met? Are the premiums sustainable, or are they eroding too much of the fund’s assets? These are important considerations for SMSF trustees to keep in mind.

Are Premiums Tax-Deductible?

In some cases, the SMSF may be able to claim a tax deduction for the insurance premiums paid, but only for certain types of cover. For example, premiums for life insurance, total and permanent disability (TPD) insurance, or income protection insurance may be deductible, provided the policies meet specific requirements.

However, the tax treatment can be complex, and not all insurance types qualify for a deduction. It’s a good idea to seek advice from a qualified financial adviser or accountant to ensure your SMSF is taking advantage of any available tax benefits while remaining compliant with the law.

Key Points to Remember

Here are the main things to keep in mind about life insurance in an SMSF:

- The SMSF owns the policy – not the individual member.

- Premiums are paid by the SMSF using the fund’s assets.

- Claim proceeds are paid to the SMSF, and the trustees are responsible for distributing them in line with superannuation law.

- Insurance premiums may be tax-deductible for the SMSF, depending on the type of cover.

Life insurance is a valuable tool in any financial plan, and when it’s part of your SMSF, it’s essential to understand how the ownership, premiums, and claim proceeds work. By ensuring compliance with Australian superannuation regulations and carefully considering the cost and benefits of your insurance, SMSF trustees can protect their members and ensure the fund meets its long-term goals.

At SMSFInsurance.com.au, we’re here to help. If you have any questions about life insurance in your SMSF don’t hesitate to get in touch. We’re always happy to help you navigate the complexities of SMSF insurance and secure the right cover for your needs – though we cant provide personal advice.

Quotes for SMSF Life Insurance are instant, and you can buy SMSF Life cover securely online.